Quantitative Easing: were markets surprised?

The ECB has announced that it will launch in March its first round of quantitative easing. The announcement contains some good and bad surprises: the size of the ECB's plan is gigantic, while the Central Bank was unclear about the Greek issue. How was this announcement perceived by markets?

By Stéphane Lhuissier

The European Central Bank has announced Thursday, not surprisingly, the launch of a programme of asset purchases, the so-called quantitative easing. What was surprising, however, was the huge size of purchases by the end of September 2016: "under this expanded programme the combined monthly purchases of public and private sector securities will amount to 60 billion," ECB President Mario Draghi said. In other words, more than one trillion Euros will be created and injected into Eurozone. Was it expected by financial markets?

The twin objective of the ECB appears relatively clear: restoring normal a functioning of the financial system within the Euro area, and averting deflation. Indeed, Mr Draghi said the Eurosystem would plan, if needed, to extend the program "until we see a sustained adjustment in the path of inflation", which the ECB has defined as "below, but close to, 2%".

Earlier this month, the inflation rate in the euro area fell below zero! The specter of a prolonged period of deflation is one of the major fears among in the Euro area countries. According to Christine Lagarde, managing director of the International Monetary Fund, deflation could "prove disastrous for the recovery".

The increase in the ECB's balance sheet through its large-scale programme of asset purchases is expected to prevent deflation, and more generally, to stimulate the economy through the fall of longer-term yields. This transmission channel, known as "the portfolio channel" was summarized by the economist Brian Sack as follows: “the purchases bid up the price of the asset and hence lower its yield. These effects would be expected to spill over other assets that are similar in nature, to the extent that investors are willing to substitute between the assets". In turn, the fall of interest rates should encourage investment, accelerate spending, and thus put prices up and boost economic growth.

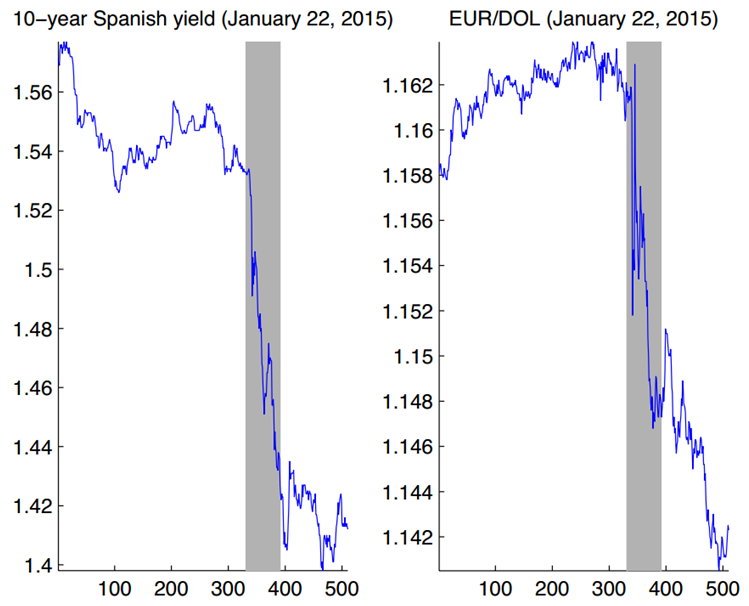

Looking at market prices, it turns out that President Draghi managed to create a positive surprise. Of course, a large part of the announcement by the ECB was expected by financial markets prior to the ECB formal decision. There exist, however, a unpredictable "component" that reveals how the ECB statement has been perceived by financial markets. For example, the left panel of Figure 1 presents a graph of intraday movements in the 10-year Spanish bond yield for the latest ECB announcement date. The grey areas indicate the period that covers the Mario Draghi speech, i.e. between 2.30pm to 3.30pm. Clearly, this graph shows that there are significant movements in the yield and that the major part of these movements can be attributed to the ECB announcement on this event day. This sharp drop captures the "surprise" in the ECB announcement and reveals that the plan has been well perceived by financial markets.

But let's also look at other yields. Table 1 presents changes in the 10-year government bond yields for several European countries in a narrow window of time surrounding the ECB statement. There are some remarkable similarities between the yields. For example, the 10-year Spanish yield falls by 154-142 = 12 basis points while at the same time, a similar fall was also observed for the German yield. The ECB announcement appears to be also significant news for France and Italy with a noticeable fall by -13 and -11, respectively. The ECB announcement appears to be the most significant news for Greece with a fall by 15 basis points. Overall, the general character of the yield adjustment suggests various things:

The twin objective of the ECB appears relatively clear: restoring normal a functioning of the financial system within the Euro area, and averting deflation. Indeed, Mr Draghi said the Eurosystem would plan, if needed, to extend the program "until we see a sustained adjustment in the path of inflation", which the ECB has defined as "below, but close to, 2%".

Earlier this month, the inflation rate in the euro area fell below zero! The specter of a prolonged period of deflation is one of the major fears among in the Euro area countries. According to Christine Lagarde, managing director of the International Monetary Fund, deflation could "prove disastrous for the recovery".

The increase in the ECB's balance sheet through its large-scale programme of asset purchases is expected to prevent deflation, and more generally, to stimulate the economy through the fall of longer-term yields. This transmission channel, known as "the portfolio channel" was summarized by the economist Brian Sack as follows: “the purchases bid up the price of the asset and hence lower its yield. These effects would be expected to spill over other assets that are similar in nature, to the extent that investors are willing to substitute between the assets". In turn, the fall of interest rates should encourage investment, accelerate spending, and thus put prices up and boost economic growth.

Looking at market prices, it turns out that President Draghi managed to create a positive surprise. Of course, a large part of the announcement by the ECB was expected by financial markets prior to the ECB formal decision. There exist, however, a unpredictable "component" that reveals how the ECB statement has been perceived by financial markets. For example, the left panel of Figure 1 presents a graph of intraday movements in the 10-year Spanish bond yield for the latest ECB announcement date. The grey areas indicate the period that covers the Mario Draghi speech, i.e. between 2.30pm to 3.30pm. Clearly, this graph shows that there are significant movements in the yield and that the major part of these movements can be attributed to the ECB announcement on this event day. This sharp drop captures the "surprise" in the ECB announcement and reveals that the plan has been well perceived by financial markets.

But let's also look at other yields. Table 1 presents changes in the 10-year government bond yields for several European countries in a narrow window of time surrounding the ECB statement. There are some remarkable similarities between the yields. For example, the 10-year Spanish yield falls by 154-142 = 12 basis points while at the same time, a similar fall was also observed for the German yield. The ECB announcement appears to be also significant news for France and Italy with a noticeable fall by -13 and -11, respectively. The ECB announcement appears to be the most significant news for Greece with a fall by 15 basis points. Overall, the general character of the yield adjustment suggests various things:

- The policy moves was bigger than expected.

- The degree of precision about the sequence and structure of purchases, as well as their country allocations, managed to generate a positive surprise.

Table 1 – Changes in the 10-year government bond yields in a narrow window (90 minutes) of time surrounding the ECB statement

| France | Germany | Spain | Italy | Greece | |

| Difference in basis points | -13.4 | -12.3 | -12.5 | -11.8 | -15.8 |

This is good news given that market prices had already largely priced a sizeable policy step. This being said, the announcement also came with explicit limitations that might prevent the ECB from signing a blank cheque on all EMU governments. In particular, Mr Mario Draghi did mention that "the Eurosystem will start to purchase euro-dominated investment grade securities issues by Euro area governments and agencies and European institutions in the second market". In other words, Greek bonds are excluded from the scheme. This means that the very preoccupying deterioration in the health of financial system in this country remains unaddressed.

Overall, how should we judge the ECB's announcement? Bond price reactions suggest it has been quite successful. Also, the Euro fell substantially after the announcement Thursday as the right panel of Figure 1 shows. The single currency sharply decreased by about 2% against the dollar, encouraging demand for exports. This also good news.

One could regret that ECB's decision to start quantitative easing has come too late. The crisis of sovereign debts in 2012 would have been better. But better late than never.

|

Figure 1 – 10-year Spanish bond yield and EUR-USD exchange rate on Jan. 22, 2015

Source: Bloomberg. Time series of 10-year Spanish yield and Euro/US Dollar. |

< Back