Through the lenses of the natural rate of interest, European monetary policy appears to be too loose since 2015

This column evaluates the ECB’s monetary policy stance based on the concept of the “natural rate of interest”. Our estimation results reveal that the ECB’s asset purchase programme seems to be too accommodating since 2015.

By Stéphane Lhuissier

In order to boost European economic growth since the financial crisis of 2007-08 and the sovereign debt crisis of 2010, the European Central Bank (ECB) drastically cut, with some hesitation[1], its main refinancing rate until reaching the zero lower bound in 2012. Since 2015, the ECB’s non-standard monetary policy measures, known as “Quantitative Easing” (QE), attempt to address the risk of deflation that threatens the euro area economic prospects.

Following these monetary actions, a debate rages constantly among economists about the modalities for ECB’s monetary policy implementation. Some urge to pursue and accentuate the ECB’s actions, by increasing the monthly quantity of financial assets purchased, while maintaining a zero interest-rate policy; others argue, on the contrary, to give up QE that they consider to be too accommodating.

In order to determine whether the stance of monetary policy is too tight, too loose or just right, it is of interest to revisit the concept of the “natural rate of interest” introduced by the Swedish economist Wicksell in 1898, and then brought up to date by the American economist Woodford in 2003.

Woodford (2003) defines the natural rate of interest as the rate that would lead an economy at full employment and with stable inflation. Specifically, this is the rate that would prevail if prices and wages had adjusted to push the level of economic activity to its full-employment level. For instance, if the nominal interest rate is above the inflation-augmented natural rate[2] then monetary conditions are too tight and the economy is underutilizing its available labor and capital resources. Conversely, a real interest rate below the natural rate leads to overutilization of productive resources and, in consequence, inflation above its target.

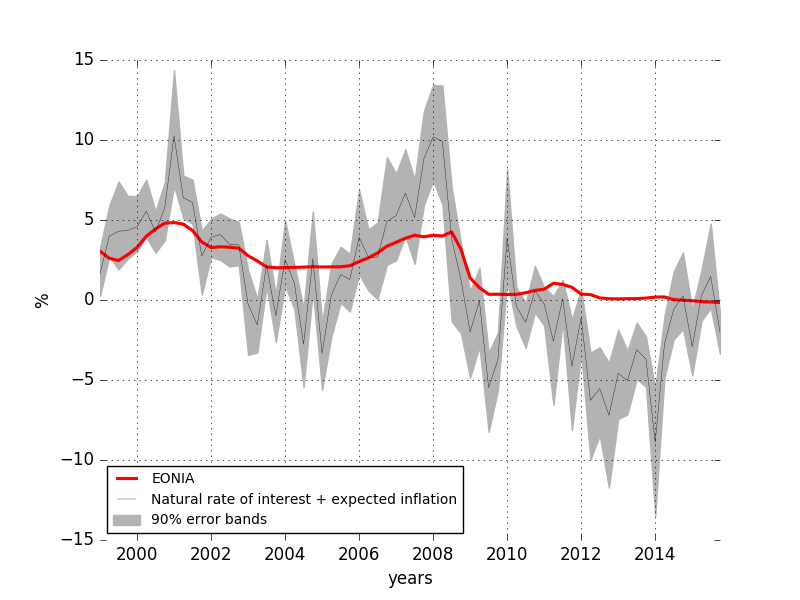

Although the natural rate is not directly observable, it can be estimated from a hypothetical economic model in which prices and wages are perfectly flexible, and devoid of shocks to the markup on goods and labor markets. In this hypothetical economy, the resulting equilibrium interest rate is the natural rate of interest, as stressed by Woodford (2003). Lhuissier (2015, forthcoming) has developed such a macroeconomic model, known as a Dynamic Stochastic General Equilibrium (DSGE) model. The below Figure represents the historical path of the estimated natural rate (plus expected inflation) obtained from this model for the euro area, along with the EONIA.

From the 2007-2014 period, EONIA is far above the natural rate. While the central bank is keeping EONIA near the zero lower bound, the natural rate has drastically declined during the Great Recession of 2007-09; the rate in 2009 was -5%, down from 5% in the early 2007. Its lowest level was, however, reached during the 2012-13 period, where it was about -9%. In consequence, the aggressive monetary easing measures conducted by ECB have not allowed the nominal interest rate to follow the estimated natural rate. Based on this estimated natural rate, monetary policy was too tight over that period.

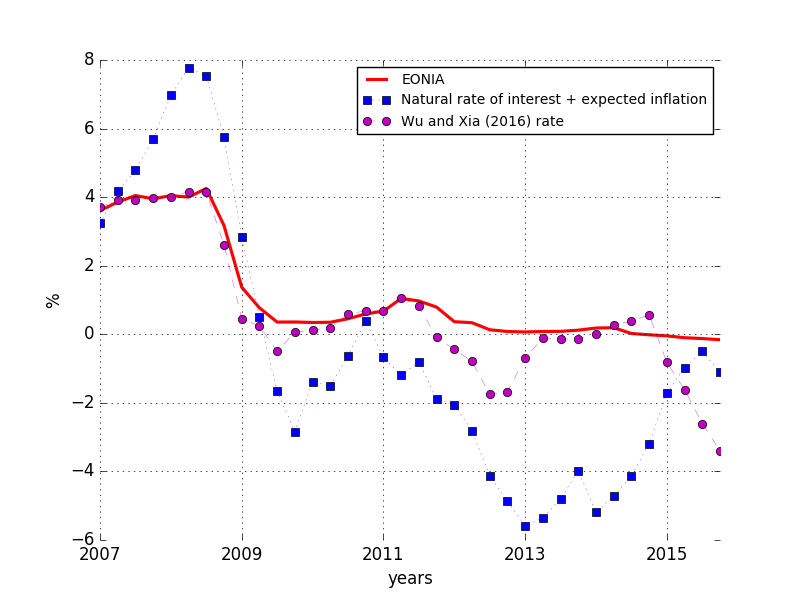

Of course, EONIA does not take into account all unconventional monetary policy measures (forward guidance, long term refinancing operations, quantitative easing, …). In a recent empirical study, Wu and Xia (2016) have constructed a shadow interest rate taking into account both conventional and unconventional measures so as to quantify the stance of ECB monetary policy at the zero lower bound. This is what shows the below Figure from 2007 to 2015.

During a large part of the zero interest-rate period, the natural rate is clearly below the Wu-Xia shadow interest rate. The difference between both rates, at its maximum level, is about 6 percentage points. Hence, according to this measure, ECB would not have successfully implemented a monetary policy in order to fully respond to shocks perturbing the economy since the global financial crisis.

Conversely, as one can see, the ECB’s asset purchase programme launched in March 2015 has pushed the shadow rate down below the natural rate, making monetary policy extremely accommodative. Indeed, although still negative, the level of the natural rate is above the level of the shadow rate. This trend could lead to search for additional yield, disproportionate risk taking by banks and excesses in financial markets, which are factors of economic and financial instability.

Nevertheless, it should be stressed that the DSGE model employed here is based on the simplifying assumption of a closed economy, and hence the international environment is entirely ignored. For example, an open-economy model taking into account the “global saving glut” thesis[3] might push the estimated natural rate of interest down[4], might reduce the estimated gap between both rates, and would relativize our conclusion that European monetary policy has been too loose since 2015.

References:

Bernanke, Ben, 2005. “The Global Saving Glut and the U.S. Current Account Deficit”, Sandridge Lecture, Virginia Association of Economics, Richmond, Virginia, Federal Reserve Board March 2005.

Lhuissier, Stéphane, 2015. “The Regime-switching volatility of Euro Area Business Cycles,” Working Papers 2015-22, CEPII research center.

Lhuissier, Stéphane, Forthcoming. “The Regime-switching Volatility of Euro Area Business Cycles”, Macroeconomic Dynamics.

Jing Cynthia Wu and Fan Dora Xia “Measuring the Macroeconomic Impact of Monetary Policy at the Zero Lower Bound”, Journal of Money, Credit, and Banking, 2016, 48(2-3), 253-291.

Woodford, Michael, “Interest and Prices: Foundations of a Theory of Monetary Policy,” Princeton University Press, 2003.

Wicksell, Knut, “Interest and Prices”, London: Macmillan, traduction par Kahn (R.F.) de Geldzins und Guterpreise, 1898.

Following these monetary actions, a debate rages constantly among economists about the modalities for ECB’s monetary policy implementation. Some urge to pursue and accentuate the ECB’s actions, by increasing the monthly quantity of financial assets purchased, while maintaining a zero interest-rate policy; others argue, on the contrary, to give up QE that they consider to be too accommodating.

In order to determine whether the stance of monetary policy is too tight, too loose or just right, it is of interest to revisit the concept of the “natural rate of interest” introduced by the Swedish economist Wicksell in 1898, and then brought up to date by the American economist Woodford in 2003.

Woodford (2003) defines the natural rate of interest as the rate that would lead an economy at full employment and with stable inflation. Specifically, this is the rate that would prevail if prices and wages had adjusted to push the level of economic activity to its full-employment level. For instance, if the nominal interest rate is above the inflation-augmented natural rate[2] then monetary conditions are too tight and the economy is underutilizing its available labor and capital resources. Conversely, a real interest rate below the natural rate leads to overutilization of productive resources and, in consequence, inflation above its target.

Although the natural rate is not directly observable, it can be estimated from a hypothetical economic model in which prices and wages are perfectly flexible, and devoid of shocks to the markup on goods and labor markets. In this hypothetical economy, the resulting equilibrium interest rate is the natural rate of interest, as stressed by Woodford (2003). Lhuissier (2015, forthcoming) has developed such a macroeconomic model, known as a Dynamic Stochastic General Equilibrium (DSGE) model. The below Figure represents the historical path of the estimated natural rate (plus expected inflation) obtained from this model for the euro area, along with the EONIA.

|

Figure 1 – Nominal natural rate of interest and EONIA, 1999-2015 |

|

|

Note : EONIA is the effective overnight interest rate(in red). For comparison purposes, the natural rate is, in black, displayed in nominal terms (that is, the sum of the real natural rate plus expected inflation). 90% probability intervals are in grey areas.

|

From the 2007-2014 period, EONIA is far above the natural rate. While the central bank is keeping EONIA near the zero lower bound, the natural rate has drastically declined during the Great Recession of 2007-09; the rate in 2009 was -5%, down from 5% in the early 2007. Its lowest level was, however, reached during the 2012-13 period, where it was about -9%. In consequence, the aggressive monetary easing measures conducted by ECB have not allowed the nominal interest rate to follow the estimated natural rate. Based on this estimated natural rate, monetary policy was too tight over that period.

Of course, EONIA does not take into account all unconventional monetary policy measures (forward guidance, long term refinancing operations, quantitative easing, …). In a recent empirical study, Wu and Xia (2016) have constructed a shadow interest rate taking into account both conventional and unconventional measures so as to quantify the stance of ECB monetary policy at the zero lower bound. This is what shows the below Figure from 2007 to 2015.

|

Figure 2 – Nominal natural rate of interest, Wu and Xia shadow rate, and EONIA |

|

|

Note : The Wu-Xia shadow interest rate is (in magenta) obtained by modeling the term structure of interest rates. The dotted blue line reports the four-quarter moving average of the nominal natural rate of interest. EONIA is in red.

|

During a large part of the zero interest-rate period, the natural rate is clearly below the Wu-Xia shadow interest rate. The difference between both rates, at its maximum level, is about 6 percentage points. Hence, according to this measure, ECB would not have successfully implemented a monetary policy in order to fully respond to shocks perturbing the economy since the global financial crisis.

Conversely, as one can see, the ECB’s asset purchase programme launched in March 2015 has pushed the shadow rate down below the natural rate, making monetary policy extremely accommodative. Indeed, although still negative, the level of the natural rate is above the level of the shadow rate. This trend could lead to search for additional yield, disproportionate risk taking by banks and excesses in financial markets, which are factors of economic and financial instability.

Nevertheless, it should be stressed that the DSGE model employed here is based on the simplifying assumption of a closed economy, and hence the international environment is entirely ignored. For example, an open-economy model taking into account the “global saving glut” thesis[3] might push the estimated natural rate of interest down[4], might reduce the estimated gap between both rates, and would relativize our conclusion that European monetary policy has been too loose since 2015.

References:

Bernanke, Ben, 2005. “The Global Saving Glut and the U.S. Current Account Deficit”, Sandridge Lecture, Virginia Association of Economics, Richmond, Virginia, Federal Reserve Board March 2005.

Lhuissier, Stéphane, 2015. “The Regime-switching volatility of Euro Area Business Cycles,” Working Papers 2015-22, CEPII research center.

Lhuissier, Stéphane, Forthcoming. “The Regime-switching Volatility of Euro Area Business Cycles”, Macroeconomic Dynamics.

Jing Cynthia Wu and Fan Dora Xia “Measuring the Macroeconomic Impact of Monetary Policy at the Zero Lower Bound”, Journal of Money, Credit, and Banking, 2016, 48(2-3), 253-291.

Woodford, Michael, “Interest and Prices: Foundations of a Theory of Monetary Policy,” Princeton University Press, 2003.

Wicksell, Knut, “Interest and Prices”, London: Macmillan, traduction par Kahn (R.F.) de Geldzins und Guterpreise, 1898.

[1] In 2011, ECB decided to raise its main refinancing rate twice (in April and July).

[2] By definition, the natural rate of interest is a real rate. For comparison purposes with a nominal rate, it is augmented to inflation.

[3] See Bernanke (2005).

[4] See, for the euro area case, the introductory speech by Mario Draghi, President of the ECB, held at a panel on “The future of financial markets: A changing view of Asia” at the Annual Meeting of the Asian Development Bank, Fankfurt am Main, 2 May 2016.

< Back