The effects of Trumpian uncertainty on U.S. economy

The election of Donald Trump has generated a climate of uncertainty about U.S. economic policy that will be implemented in the near future. How much should we worry about this “Trumpian uncertainty”?

By Fabien Tripier, Stéphane Lhuissier

The World Bank recently revised downwards its GDP growth forecast for 2017 by putting forward increased uncertainty caused by the election Donald Trump. A few months ago, the large Brexit vote also resulted in pessimistic predictions [1]. Yet, these predictions had been contradicted by several major macroeconomic indicators, compelling the Bank of England’s chief economist to admit that Brexit did not lead to “concrete effects” - Paul Krugman has also cast doubt about the macroeconomic effects of Brexit [2].

This post shows how recent academic research on uncertainty allows enlightening this debate by measuring the economic cost of uncertainty created by the election of Donald Trump [3].

Economists have –for a long time– been looking at the consequences of uncertainty. New empirical methods allow to measure its intensity over time and then to quantify its impact on business cycle fluctuations. Nicholas Bloom from Stanford University and his co-authors have developed an indicator of uncertainty, which is undoubtedly relevant to evaluate the economic consequences of political events such as the economic policy uncertainty (see the website http://www.policyuncertainty.com/index.html for a presentation of the methodology and this blog for an illustration with the Brexit).

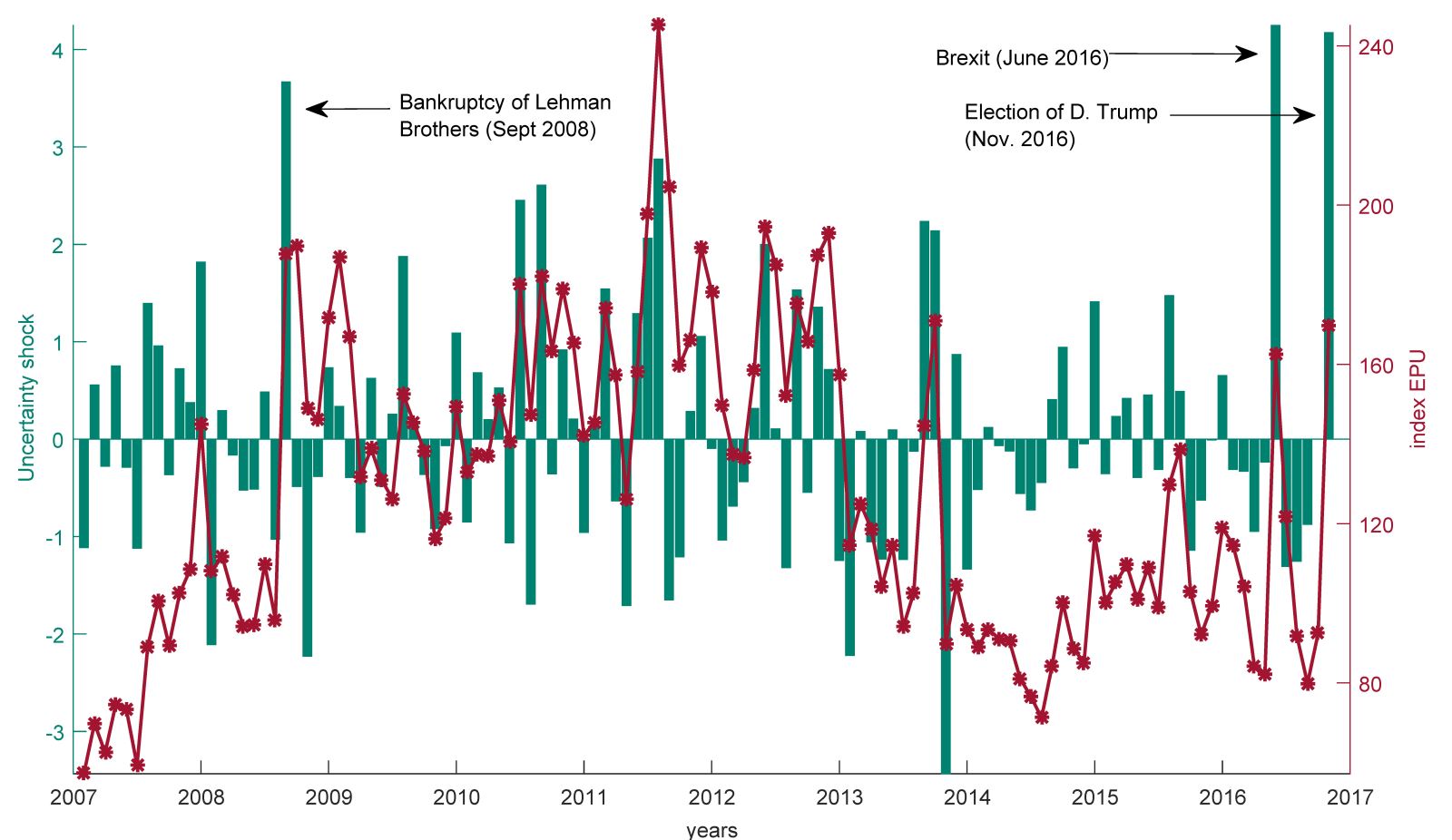

Figure 1 shows the historical path of uncertainty measured by this indicator in the United States (red line) and the time series of structural shocks of uncertainty [4] (green bar) that hit the U.S. economy since 2007. The recent period has been characterized by two major and equivalent shocks on economic policy: the results of the European Union referendum in the United Kingdom in June 2016 and the election of Donald Trump in November 2016. Both events have resulted in a sudden rise in uncertainty, which are at a similar level to September 2008 (Bankruptcy of Lehman Brothers).

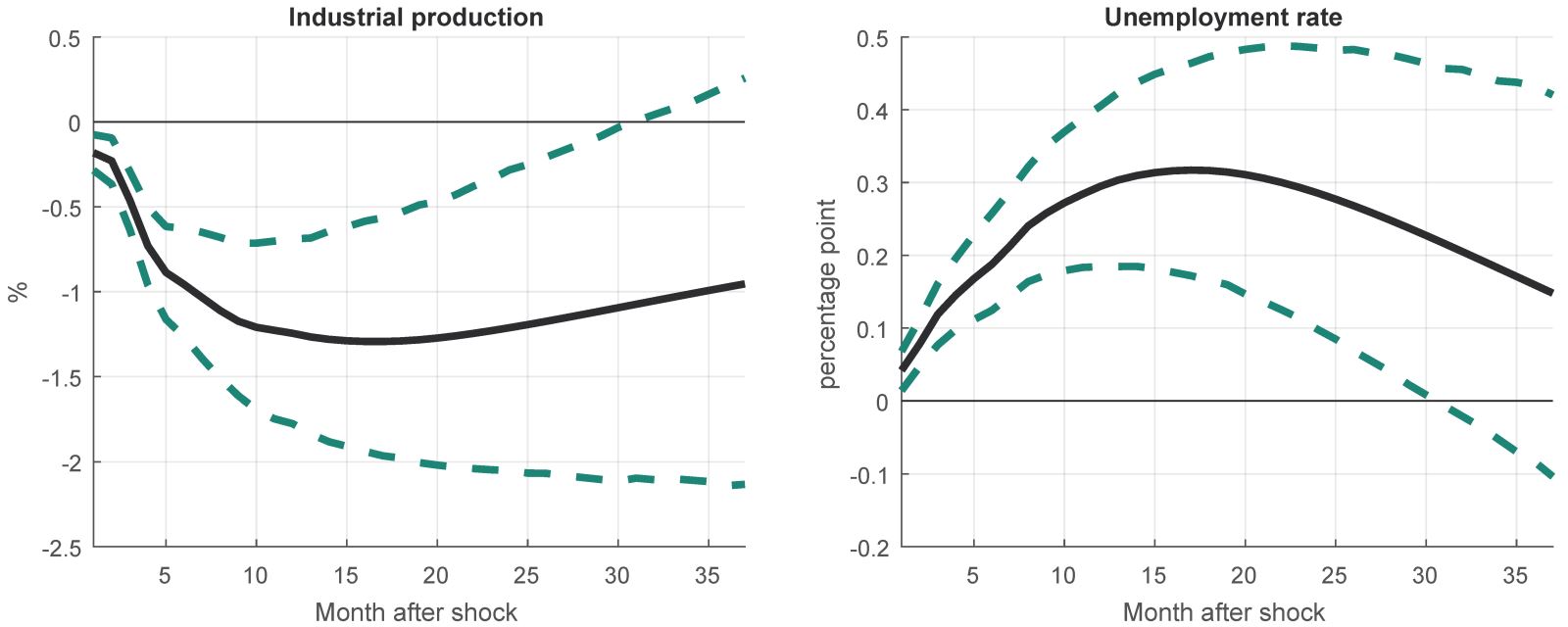

Figure 2 describes the economic effects of an uncertainty shock, which was measured by the election of Donald Trump in September 2016, which we refer to as “The Trumpian uncertainty shock”.

According to figure 2, this event should lead to contractionary effects on the economy. Indeed, industrial production declines sharply and unemployment rises. Also, this figure relates two additional useful information, which enlighten the debate on the role of uncertainty.

The first information is about the amplitude of these effects: they are substantial. The Trumpian uncertainty shock causes, at its maximum, a rise in unemployment rate by 0.3 percentage point and a decrease in industrial production by 1.25 percent. The second information is about the persistence of these effects: they are amplified over time. The most important effects occur from one year and a half after the shock.

The good state of the American economy does not mean that uncertainty should have no effect, but that these effects can be covered up by other favorable factors which are quantitatively more important such as the coming Trump fiscal stimulus. Without such factors, unemployment could be even lower and output much higher. Furthermore, given the long-lasting effects of our Trumpian uncertainty shock, the macroeconomic effects could appear within the next few months. Finally, it is worth remembering that our estimates focus only on one specific characteristic of uncertainty, i.e. economic policy uncertainty, and does not take into account, for example, uncertainty in financial markets in the United States, which remain relatively stable at the moment.

This post shows how recent academic research on uncertainty allows enlightening this debate by measuring the economic cost of uncertainty created by the election of Donald Trump [3].

Economists have –for a long time– been looking at the consequences of uncertainty. New empirical methods allow to measure its intensity over time and then to quantify its impact on business cycle fluctuations. Nicholas Bloom from Stanford University and his co-authors have developed an indicator of uncertainty, which is undoubtedly relevant to evaluate the economic consequences of political events such as the economic policy uncertainty (see the website http://www.policyuncertainty.com/index.html for a presentation of the methodology and this blog for an illustration with the Brexit).

Figure 1 shows the historical path of uncertainty measured by this indicator in the United States (red line) and the time series of structural shocks of uncertainty [4] (green bar) that hit the U.S. economy since 2007. The recent period has been characterized by two major and equivalent shocks on economic policy: the results of the European Union referendum in the United Kingdom in June 2016 and the election of Donald Trump in November 2016. Both events have resulted in a sudden rise in uncertainty, which are at a similar level to September 2008 (Bankruptcy of Lehman Brothers).

|

Figure 1 – Economic policy uncertainty (red) and structural shocks of uncertainty (green) |

|

|

Note: Shocks were estimated with structural VAR model for the January 1985 – November 2016 period with the following order of variables : uncertainty, industrial production (log), unemployment rate, federal funds rate, and S&P500 (log). Identification scheme : Cholesky. Source : Fed FRED, http://www.policyuncertainty.com/index.html.

|

|

Figure 2 – The effects of a Trumpian uncertainty shock on industrial production and unemployment in the United States

|

|

|

|

The first information is about the amplitude of these effects: they are substantial. The Trumpian uncertainty shock causes, at its maximum, a rise in unemployment rate by 0.3 percentage point and a decrease in industrial production by 1.25 percent. The second information is about the persistence of these effects: they are amplified over time. The most important effects occur from one year and a half after the shock.

The good state of the American economy does not mean that uncertainty should have no effect, but that these effects can be covered up by other favorable factors which are quantitatively more important such as the coming Trump fiscal stimulus. Without such factors, unemployment could be even lower and output much higher. Furthermore, given the long-lasting effects of our Trumpian uncertainty shock, the macroeconomic effects could appear within the next few months. Finally, it is worth remembering that our estimates focus only on one specific characteristic of uncertainty, i.e. economic policy uncertainty, and does not take into account, for example, uncertainty in financial markets in the United States, which remain relatively stable at the moment.

[1] See the Speech « Uncertainty about Uncertainty » given by Kristin Forbes, External MPC Member, Bank of England, the 23 November 2016.

[2] We discuss about this issue in a previous post, available here.

[3] See http://www.policyuncertainty.com/media/Brexit_Discussion.pdf for a study on the consequences of Brexit.

[4] Structural shocks of uncertainty represent the non-systematic component of the economic policy uncertainty.

< Back