Financial development in India and firms’ growth

The banking reforms that took place in India in the mid 90s have improved the availability of credit. However, the effects of financial development on firms’ growth appear to be unequal depending on their characteristics. Where are the gains from credit expansion concentrated?

Par Maria Bas, Antoine Berthou

Banking reforms through financial development might enhance economic growth through different channels. Credit expansion increases the financial resources available for companies, therefore relaxing credit constraints. In principle, financial development should promote aggregate economic growth, as it allows firms to invest more and engage into profitable projects.

A second channel through which financial development might affect aggregate economic growth is the reallocation of market shares across companies. Banking reforms in India allowed private and foreign banks to set up more branches in Indian States, which resulted into an increased competition in the credit market. Such competition can be detrimental to less profitable and smaller firms, as banks compete to attract the best performing (and less risky) ones, i.e. large companies.

The reform of the banking sector might have a different impact across Indian states depending on the degree of financial development of each location. One way of measuring differences across Indian states in the characteristics and degree of development of their financial institutions is to rely on the credit over GDP ratio at the state level. Figure 1 presents the distribution of credit over GDP ratio across 21 Indian states in 1997. As can be seen, the level of financial development captured by the credit ratio is heterogeneous across regions.

A second channel through which financial development might affect aggregate economic growth is the reallocation of market shares across companies. Banking reforms in India allowed private and foreign banks to set up more branches in Indian States, which resulted into an increased competition in the credit market. Such competition can be detrimental to less profitable and smaller firms, as banks compete to attract the best performing (and less risky) ones, i.e. large companies.

The reform of the banking sector might have a different impact across Indian states depending on the degree of financial development of each location. One way of measuring differences across Indian states in the characteristics and degree of development of their financial institutions is to rely on the credit over GDP ratio at the state level. Figure 1 presents the distribution of credit over GDP ratio across 21 Indian states in 1997. As can be seen, the level of financial development captured by the credit ratio is heterogeneous across regions.

Figure 1 - Credit / GDP in Indian States (1997).

.bmp)

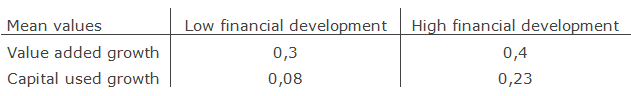

Indian states can be classified according to their level of financial development. Those states that have a growth of credit over GDP ratio between 1997 and 2006 that is higher than the median growth of credit ratio are classified as states with a high degree of financial development. While those states that have experienced a growth of credit ratio that is lower than the median are considered as low financial developed states. Table 1 shows the average growth in value added and capital investment for firms located in low- and high- financial developed states. Companies producing in states where the credit expansion was greater have experienced a higher growth.

Table 1: Financial development and companies’ value added and capital used growth

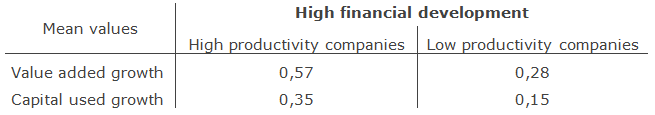

Which are the firms that have benefited most from the financial reform? In the case of India, financial development has affected companies’ production and capital investments growth differently depending on the performance of companies. Credit expansion had a greater effect on companies that were initially larger, more productive or more profitable. Table 2 shows the growth of value added and capital used for high- and low- productivity firms. High-productivity firms are those that have a TFP level in 1997 that is higher than the median TFP, and low-productivity firms are those that present a TFP level in 1997 that is lower than the median sample TFP. This table shows that most productive companies located in high financial developed states have experienced a greater growth of value added and capital used relative to least productive firms.

Table 2 - Heterogeneous effect of financial development on companies’ growth

Table 2 - Heterogeneous effect of financial development on companies’ growth

Can we also identify heterogeneity across sectors? The technical characteristics of the production process that are specific to each sector are associated with different levels of dependence on external finance. For example, the capital equipment industry requires higher investments and therefore it depends more on the access to external financial resources than the food industry. Considering these differences in the dependence on external finance across sectors reveals that the companies operating in sectors using more external finance did benefit more from the improvement of the financing conditions across Indian States. In these sectors, both medium-size and large firms have expanded more rapidly than small firms.

|

Retrouvez plus d'information sur le blog du CEPII. © CEPII, Reproduction strictement interdite. Le blog du CEPII, ISSN: 2270-2571 |

|||

|