In search of a liquid asset for European financial markets

European financial markets face a shortage of liquid assets. New regulations increase banks’ demand for liquid securities, mainly sovereign bonds, but the European fiscal rules constrain the supply of public debt. Further, the QE is draining bonds from the market. Some proposed forms of “Eurobonds” or new debt securities issued by European supranational organizations could solve this problem.

By Francesco Molteni

A current debate in international macroeconomics is the shortage of a global safe asset that contributes to the secular stagnation. At the zero lower bound and with price rigidities, the real interest rate cannot adjust in response to the decrease in the supply of safe assets and the equilibrium is restored via a reduction in the demand for safe assets which generates a fall in output (Farhi and Caballero, 2014). In Europe the lack of a safe asset undermines the financial stability since reinforces the “diabolic loop”, the nexus between sovereign and bank credit risk. In order to increase the supply of safe assets, several authors propose the creation of synthetic bonds formed by senior tranches of a set of national bonds in fixed proportion which do not require debt mutualization, preserve the market discipline by differentiating credit risk across countries and provide a target for ECB operations in the context of quantitative easing (Benassy-Quéré (2012), Brunnermeier et al. (2016), Corsetti et al. (2016) and Garicano and Reichlin (2014)).

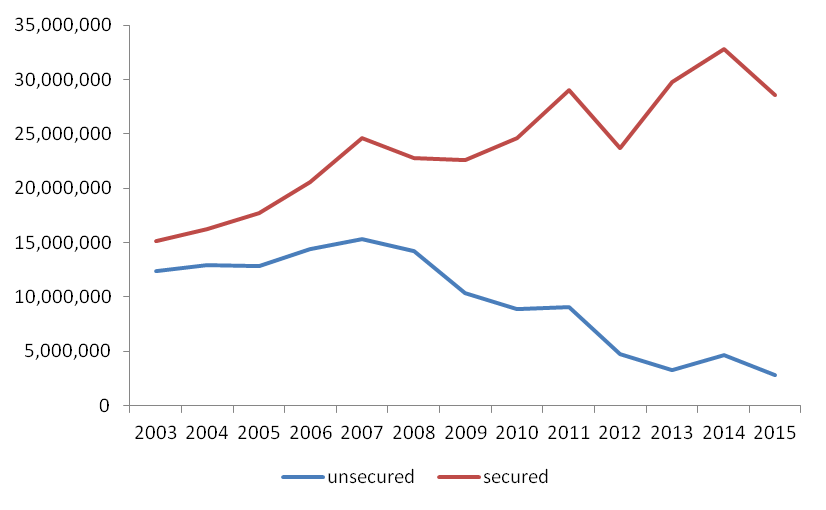

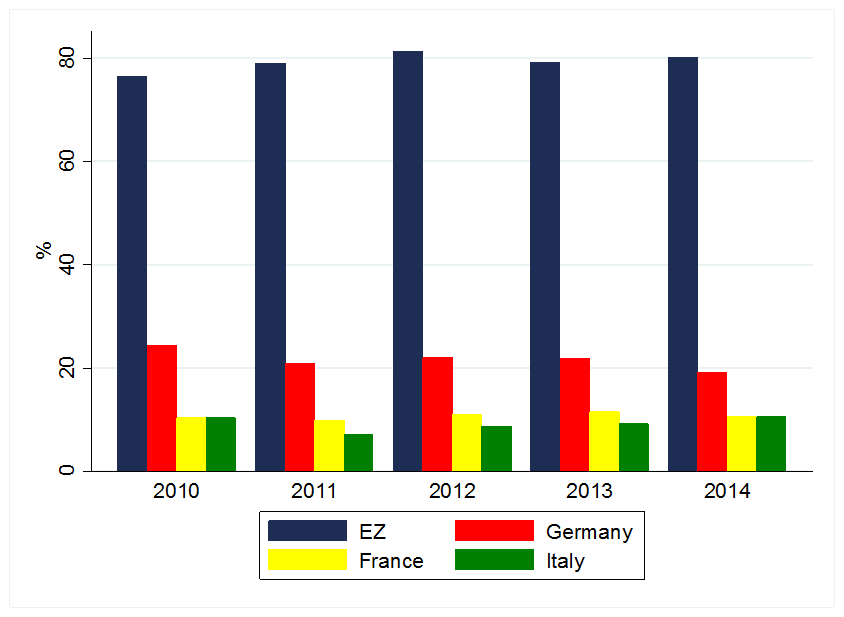

Another relevant issue for the European financial market is the shortage of a liquid asset. Although safety and liquidity are linked, they are different concepts. The former is related to the credit risk – the probability that the issuer does not repay entirely the debt - and consequently the capacity of an asset to fulfill prudential requirements (Gourinchas and Jeanne, 2012). The latter refers to the ease of an asset to be exchanged easily – sold at short notice without needing to offer a discount price - and to serve as pledge for transactions. In the global context, Eichengreen (2016) suggests that the deficit of a liquid asset, typically US Treasuries, could be one of the explanation for the observed collapse in cross-border banking flows (Bussière et al. (2016) and Milesi-Ferretti and Tille (2011)). This problem is even more acute in Europe. Since the onset of the global financial crisis, the demand for securities that can serve as collateral in the interbank market has increased substantially, driven by the shift from unsecured to secured funding due to the rise in counterparty credit risk (Figure 1). Figure 2 shows that government bonds play a key role as collateral securities in the European market of repurchase agreements (repos), which provide them a special liquid role that can explain why banks hold a sizeable amount of public debt in their portfolios (Gennaioli et al., 2014).[1] However, the emergence of sovereign risk in peripheral countries during the crisis led to a generalized increase in repo haircuts[2], which reduced their capacity to serve as collateral and generated a flight-to-liquidity towards the bonds issued by safer core countries which drove up to the yield spreads of peripheral government bonds (Molteni, 2015).

In this context, bonds issued by core countries, and in particular the German bunds, are the main safe and liquid assets in the European financial market. However, their issuance is limited by European fiscal rules adopted in the wake of the sovereign debt crises, such as the Six-Pack, the Fiscal Compact and Two-Pack, together with the “Debt Brake” in Germany which imposes strict borrowing limits (Deutsche Bundesbank, 2011). At the same time, the ECB, with its Expanded Asset Purchase Programme (APP), is purchasing 80 billion per month of mainly eurozone government bonds, reducing the net supply of these assets (Gerba and Macchiarelli, 2015).[3] German bonds could be exhausted before the end of the programme in March 2017.[4]

At the zero lower bound, the disequilibrium between the demand and the supply of liquid assets increases the pressure on the negative yields of several Eurozone government bonds (Aglietta and Valla, 2016; Couppey-Soubeyran, 2016). In addition, new international banking regulations (Basel III and more indirectly EMIR and MIFID II) are going to foster the secured funding and consequently the demand for liquid assets used as collateral securities. The Liquidity Coverage Ratio (LCR) and the Net Stable Funding Ratio (NSFR) assign higher run-off coefficients on secured funding than unsecured funding, since the former is considered a more resilient source of financing for financial institutions. As a consequence, it will incentivize banks to borrow in the repo market, increasing their demand for High Quality Liquid Assets (HQLAs), in primis government bonds, in order to meet the new regulatory requirements.

However, the LCR could not reduce the problem of flight-to-liquidity observed during the sovereign debt crisis, but in contrast it could exacerbate it. Indeed government bonds, which do not have a proven record as a reliable source of liquidity in the markets (repo or sale) during stressed market conditions[5]” (BCBS(2013), p.13), are not considered as HQLAs. Accordingly, in a future scenario of a fiscal crisis, banks could sell even more government bonds of distressed countries.

Synthetic assets, such as the Euro Safe Bonds (ESBies), could be a possible solution to increase the supply of liquid assets without entailing problems of debt sharing between Euro area members. Nevertheless, even though a political agreement would arise around these new debt instruments, it will require time to design the necessary rules and institutions. A more pragmatic solution would be to increase the supply of debt securities of supranational organizations. In particular, the European Investment Bank could finance a larger share of the Juncker’s Investment Plan via the emission of bonds that the European Central Bank could accept as collateral in its refinancing operations.

A larger emission of a safe and liquid asset appears necessary also for the accomplishment of the European Capital Market Union, which depends on its capacity to attract funding suppliers, especially institutional investors such as pensions and insurance sectors, which need to hold a substantial proportion of their asset portfolio in the form of safe and liquid assets (European Commission, 2015). Policymakers should find quickly a solution for the shortage of a liquid asset otherwise shocks which generate flight-to-quality, such as the Brexit, could be amplified by a flight-to-liquidity jeopardizing the financial stability which new regulations are reinforcing.

References:

Aglietta, M. and Valla, N. 2016. “Taux d’intérêt négatifs et stagnation séculaire : politique monétaire ou choix sociétal ?”, Panorama du CEPII, N°2016-01, février 2016.

Basel Committee on Banking Supervision. 2013. “Basel III: the liquidity coverage ratio and liquidity risk monitoring tools”, Bank for International Settlements.

Benassy-Quéré, A. 2012. “Euro: Comment éviter la catastrophe?”, Telos, 11 June.

Brunnermeier, M. K., Garicano, L., Lane, P. R., Pagano, M., Reis, R., Santos, Tano, Thesmar, D., Van Nieuwerburgh, Stijn & Vayanos, D. 2016 "The Sovereign-Bank Diabolic Loop and ESBies,"American Economic Review 6(5).

Bussière, M., Schmidt, J. & Valla, N. 2016. “International Financial Flows in the New Normal: Key Patterns (and Why We Should Care), CEPII Policy Brief, N. 10, March 2016.”

Corsetti, G., L.P. Feld, P. Lane, L. Reichlin, H. Rey, D. Vayanos & B. Weder di Mauro. 2016. Reinforcing the Eurozone and Protecting an Open Society, London CEPR Press.

Couppey-Soubeyran, J. 2016. “Taux négatif : arme de poing ou signal de détresse ?”

Revue d'économie financière, N°121 (1-2016), Mai 2016.

Deutsche Bundesbank. 2011. “The debt brake in Germany – key aspects and implementation,” Monthly Report October 2011.

European Commission. 2015. Green paper: Building on a capital Markets union, COM (2015) 63 final, Brussels, 18th February.

Eichengreen B. 2016. “Financial Scarcity Amid Plenty” Project Syndacated, June 2016

Farhi, Emmanuel, and Ricardo J Caballero. 2014. On the role of safe asset shortages in secular stagnation. Secular Stagnation: Facts, Causes, and Cures. London: CEPR Press, 111-122.

Garicano, L. & Reichlin, L.. 2014. “A safe asset for Eurozone QE: A proposal”, VoxEu.org, 14 November.

Gennaioli, N., Martin, A. and Rossi, S. 2014. "Banks, Government Bonds, and Default; What do the Data Say?," IMF Working Papers 14/120, International Monetary Fund.

Gerba, E. & Macchiarelli, C. 2015. “Sovereign bond purchases and risk sharing arrangements: Sharing: Myth and Reality of the European QE,” SRC Special Paper, N. 9, October.

Gourinchas, P.-O. & Jeanne, O. 2012. "Global safe assets," BIS Working Papers 399, Bank for International Settlements.

Krishnamurthy, A. and Vissing-Jorgensen. 2012. “The Aggregate Demand for Treasury Debt”, Journal of Political Economy 120, 233-267.

Milesi-Ferretti, G.M. & Tille, C. 2011. “The Great Retrenchment: International Capital Flows during the Global Financial Crisis,” Economic Policy Vol.66, pag 28-346.

Molteni, F. 2015. “Liquidity, Government Bonds and Sovereign Debt Crises,” CEPII Working Paper, N. 2015-32.

Another relevant issue for the European financial market is the shortage of a liquid asset. Although safety and liquidity are linked, they are different concepts. The former is related to the credit risk – the probability that the issuer does not repay entirely the debt - and consequently the capacity of an asset to fulfill prudential requirements (Gourinchas and Jeanne, 2012). The latter refers to the ease of an asset to be exchanged easily – sold at short notice without needing to offer a discount price - and to serve as pledge for transactions. In the global context, Eichengreen (2016) suggests that the deficit of a liquid asset, typically US Treasuries, could be one of the explanation for the observed collapse in cross-border banking flows (Bussière et al. (2016) and Milesi-Ferretti and Tille (2011)). This problem is even more acute in Europe. Since the onset of the global financial crisis, the demand for securities that can serve as collateral in the interbank market has increased substantially, driven by the shift from unsecured to secured funding due to the rise in counterparty credit risk (Figure 1). Figure 2 shows that government bonds play a key role as collateral securities in the European market of repurchase agreements (repos), which provide them a special liquid role that can explain why banks hold a sizeable amount of public debt in their portfolios (Gennaioli et al., 2014).[1] However, the emergence of sovereign risk in peripheral countries during the crisis led to a generalized increase in repo haircuts[2], which reduced their capacity to serve as collateral and generated a flight-to-liquidity towards the bonds issued by safer core countries which drove up to the yield spreads of peripheral government bonds (Molteni, 2015).

In this context, bonds issued by core countries, and in particular the German bunds, are the main safe and liquid assets in the European financial market. However, their issuance is limited by European fiscal rules adopted in the wake of the sovereign debt crises, such as the Six-Pack, the Fiscal Compact and Two-Pack, together with the “Debt Brake” in Germany which imposes strict borrowing limits (Deutsche Bundesbank, 2011). At the same time, the ECB, with its Expanded Asset Purchase Programme (APP), is purchasing 80 billion per month of mainly eurozone government bonds, reducing the net supply of these assets (Gerba and Macchiarelli, 2015).[3] German bonds could be exhausted before the end of the programme in March 2017.[4]

At the zero lower bound, the disequilibrium between the demand and the supply of liquid assets increases the pressure on the negative yields of several Eurozone government bonds (Aglietta and Valla, 2016; Couppey-Soubeyran, 2016). In addition, new international banking regulations (Basel III and more indirectly EMIR and MIFID II) are going to foster the secured funding and consequently the demand for liquid assets used as collateral securities. The Liquidity Coverage Ratio (LCR) and the Net Stable Funding Ratio (NSFR) assign higher run-off coefficients on secured funding than unsecured funding, since the former is considered a more resilient source of financing for financial institutions. As a consequence, it will incentivize banks to borrow in the repo market, increasing their demand for High Quality Liquid Assets (HQLAs), in primis government bonds, in order to meet the new regulatory requirements.

However, the LCR could not reduce the problem of flight-to-liquidity observed during the sovereign debt crisis, but in contrast it could exacerbate it. Indeed government bonds, which do not have a proven record as a reliable source of liquidity in the markets (repo or sale) during stressed market conditions[5]” (BCBS(2013), p.13), are not considered as HQLAs. Accordingly, in a future scenario of a fiscal crisis, banks could sell even more government bonds of distressed countries.

Synthetic assets, such as the Euro Safe Bonds (ESBies), could be a possible solution to increase the supply of liquid assets without entailing problems of debt sharing between Euro area members. Nevertheless, even though a political agreement would arise around these new debt instruments, it will require time to design the necessary rules and institutions. A more pragmatic solution would be to increase the supply of debt securities of supranational organizations. In particular, the European Investment Bank could finance a larger share of the Juncker’s Investment Plan via the emission of bonds that the European Central Bank could accept as collateral in its refinancing operations.

A larger emission of a safe and liquid asset appears necessary also for the accomplishment of the European Capital Market Union, which depends on its capacity to attract funding suppliers, especially institutional investors such as pensions and insurance sectors, which need to hold a substantial proportion of their asset portfolio in the form of safe and liquid assets (European Commission, 2015). Policymakers should find quickly a solution for the shortage of a liquid asset otherwise shocks which generate flight-to-quality, such as the Brexit, could be amplified by a flight-to-liquidity jeopardizing the financial stability which new regulations are reinforcing.

|

Figure 1 – Cumulative quarterly turnover in the euro money market (euro millions) |

|

|

Note: The panel comprises 98 credit institutions. Source: European Money Market Survey (European Central Bank). https://www.ecb.europa.eu/stats/money/mmss/html/index.en.html. |

| Figure 2 – Share of government bonds in the pool of collateral securities in the European repo market |

|

|

Note: The panel comprises 67 credit institutions. EZ = all Eurozone countries Source: European Repo Survey (International Capital Market Association). http://www.icmagroup.org/Regulatory-Policy-and-Market-Practice/short-term-markets/Repo-Markets/repo/. |

References:

Aglietta, M. and Valla, N. 2016. “Taux d’intérêt négatifs et stagnation séculaire : politique monétaire ou choix sociétal ?”, Panorama du CEPII, N°2016-01, février 2016.

Basel Committee on Banking Supervision. 2013. “Basel III: the liquidity coverage ratio and liquidity risk monitoring tools”, Bank for International Settlements.

Benassy-Quéré, A. 2012. “Euro: Comment éviter la catastrophe?”, Telos, 11 June.

Brunnermeier, M. K., Garicano, L., Lane, P. R., Pagano, M., Reis, R., Santos, Tano, Thesmar, D., Van Nieuwerburgh, Stijn & Vayanos, D. 2016 "The Sovereign-Bank Diabolic Loop and ESBies,"American Economic Review 6(5).

Bussière, M., Schmidt, J. & Valla, N. 2016. “International Financial Flows in the New Normal: Key Patterns (and Why We Should Care), CEPII Policy Brief, N. 10, March 2016.”

Corsetti, G., L.P. Feld, P. Lane, L. Reichlin, H. Rey, D. Vayanos & B. Weder di Mauro. 2016. Reinforcing the Eurozone and Protecting an Open Society, London CEPR Press.

Couppey-Soubeyran, J. 2016. “Taux négatif : arme de poing ou signal de détresse ?”

Revue d'économie financière, N°121 (1-2016), Mai 2016.

Deutsche Bundesbank. 2011. “The debt brake in Germany – key aspects and implementation,” Monthly Report October 2011.

European Commission. 2015. Green paper: Building on a capital Markets union, COM (2015) 63 final, Brussels, 18th February.

Eichengreen B. 2016. “Financial Scarcity Amid Plenty” Project Syndacated, June 2016

Farhi, Emmanuel, and Ricardo J Caballero. 2014. On the role of safe asset shortages in secular stagnation. Secular Stagnation: Facts, Causes, and Cures. London: CEPR Press, 111-122.

Garicano, L. & Reichlin, L.. 2014. “A safe asset for Eurozone QE: A proposal”, VoxEu.org, 14 November.

Gennaioli, N., Martin, A. and Rossi, S. 2014. "Banks, Government Bonds, and Default; What do the Data Say?," IMF Working Papers 14/120, International Monetary Fund.

Gerba, E. & Macchiarelli, C. 2015. “Sovereign bond purchases and risk sharing arrangements: Sharing: Myth and Reality of the European QE,” SRC Special Paper, N. 9, October.

Gourinchas, P.-O. & Jeanne, O. 2012. "Global safe assets," BIS Working Papers 399, Bank for International Settlements.

Krishnamurthy, A. and Vissing-Jorgensen. 2012. “The Aggregate Demand for Treasury Debt”, Journal of Political Economy 120, 233-267.

Milesi-Ferretti, G.M. & Tille, C. 2011. “The Great Retrenchment: International Capital Flows during the Global Financial Crisis,” Economic Policy Vol.66, pag 28-346.

Molteni, F. 2015. “Liquidity, Government Bonds and Sovereign Debt Crises,” CEPII Working Paper, N. 2015-32.

[1] A repurchase agreement (repo) is an agreement between two parties on the sale and subsequent repurchase of securities at an agreed price. In economic terms, it is analogous to a loan secured by securities, typically government bonds.

[2] The haircut or initial margin is the percentage difference between the value of the loan and the value of the collateral. For instance, if the loan is €90 euro and the value of collateral is €100, the haircut is 10%.

[3] The problem of scarcity of government bonds as collateral is more pronounced for Europe, where there is a smaller substitutability between public and private debt than in US (see Krishnamurthy and Vissing-Jorgensen, 2012).

[4] See Wall Street Journal “European Central Bank faces Questions Over Which Bonds to Buy”, March 4 2016.

[5] “maximum decline of price not exceeding 10% or increase in haircuts not exceeding 10 percentage points over a 30-day period during a relevant period of significant liquidity stress”.

< Back