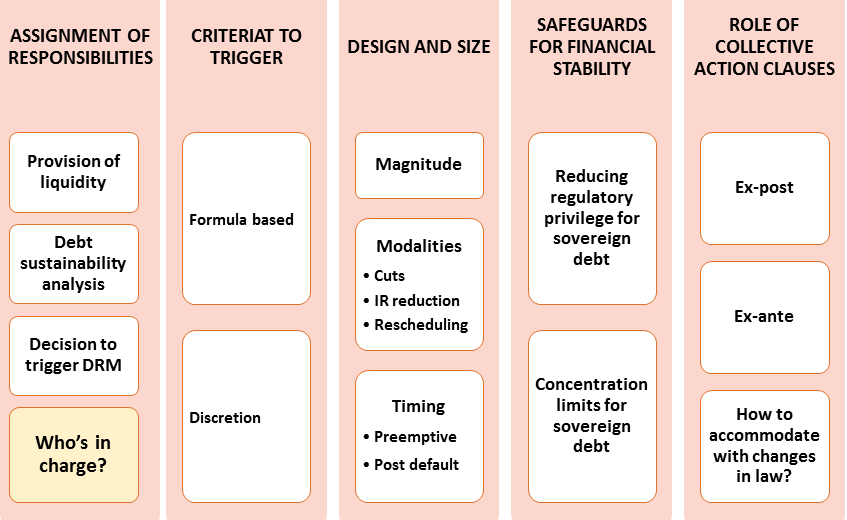

This paper critically assesses several dimensions of a sovereign debt restructuring mechanism (SDRM) for the euro area. The novelty of our analysis is that we abstain from recommending one ideal model for a restructuring mechanism. Instead, we apply a menu-type approach. For five key institutional SDRM dimensions, we discuss the underlying fundamental trade-offs and discuss the pros and cons of different design choices. Specifically, we investigate the following SDRM dimensions: (i) the institutional assignments of responsibilities, (ii) the condition or decision rule that triggers a debt restructuring, (iii) the design and size of debt restructuring, (iv) the role and details of collective action clauses (CACs), and (v) the safeguards for financial stability in support for a SDRM. We conclude that there is no such thing as the single optimal SDRM. Design decisions require judgements on the underlying trade-offs and related assumptions on relative costs. Also, the search for an appropriate euro area SDRM design can benefit from complementarities. Ambition in one dimension can offer more degrees of freedom in another dimension. Our analysis implies that there is no convincing reason to further taboo the search for a euro area SDRM, as there are ways to combine the opportunities of a credible SDRM with financial stability. Christophe Destais, Frederik Eidam & Friedrich Heinemann >>> |

- The design of a sovereign debt restructuring mechanism for the euro area: Choices and trade-offs

Christophe Destais, Frederik Eidam, Friedrich Heinemann

- The "new silk roads": an evaluation essay

(2/4): The Belt, Corridors and roads

Michel Fouquin, Jean-Raphaël Chaponnière - L’Europe face aux guerres commerciales

Sébastien Jean - La Chine à l'offensive commerciale

Sébastien Jean - Chine et Europe

Sébastien Jean - Quel avenir pour la PAC après le Brexit ?

Lionel Fontagné - The "new silk roads": an evaluation essay

(1/4): A Chinese vision of globalization

Michel Fouquin, Jean-Raphaël Chaponnière

- The Exorbitant Privilege of High Tax Countries

Vincent Vicard - Heterogeneity within the Euro Area: New Insights into an Old Story

Virginie Coudert, Cécile Couharde, Carl Grekou, Valérie Mignon - Activism and Trade

Pamina Koenig, Sandra Poncet - International Business Cycles: Information Matters

Eleni Iliopulos, Erica Perego, Thepthida Sopraseuth

- Journal of International Economics

Does Exporting Improve Matching? Evidence from French Employer-Employees data

Matilde Bombardini, Gianluca Orefice, Maria Tito

Theories and Methods in Macroeconomics (T2M) - 23rd Conference

March 22 - 23, 2019

“US Trade Policy: Before, During, and After Trump” with Chad P. Bown, Reginald Jones Senior Fellow at the Peterson Institute for International Economics

March 22, 2019

"The economic history of China's Empire and its influence on contemporary China" by Professor Richard Von Glahn, UCLA

June 4, 2019

19th Doctoral Meetings in International Trade and International Finance

June 27 - 28, 2019

The Exorbitant Privilege of High Tax Countries Excess returns on foreign assets owe largely to yield differential within the FDI asset class and are correlated to the corporate tax rate for a large sample of countries, consistently with tax motivated profit shifting by multinational corporations. Vincent Vicard >>> |

The "new silk roads": an evaluation essay (1/4): A Chinese vision of globalization For more than thirty years, China has recorded exceptional trade surpluses and accumulated extraordinary financial reserves, which are almost twice those of its immediate follower Japan. These surpluses are an inconvenience to its most important partners, such as the United States and the European Union.(2/4): The Belt, Corridors and roads Initially Belt and Road Initiative (BRI) focussed on transport infrastructure and pipelines on the one hand and Europe-Asia connectivity on the other hand. It aims at building an Eurasian Belt as well as several corridors leading to maritime roads.

Michel Fouquin, Jean-Raphaël Chaponnière

|

- Contact us

- Our other sites

|

ISSN: 1255-7072

Editorial Director : Antoine BouëtManaging Editor : Dominique Pianelli