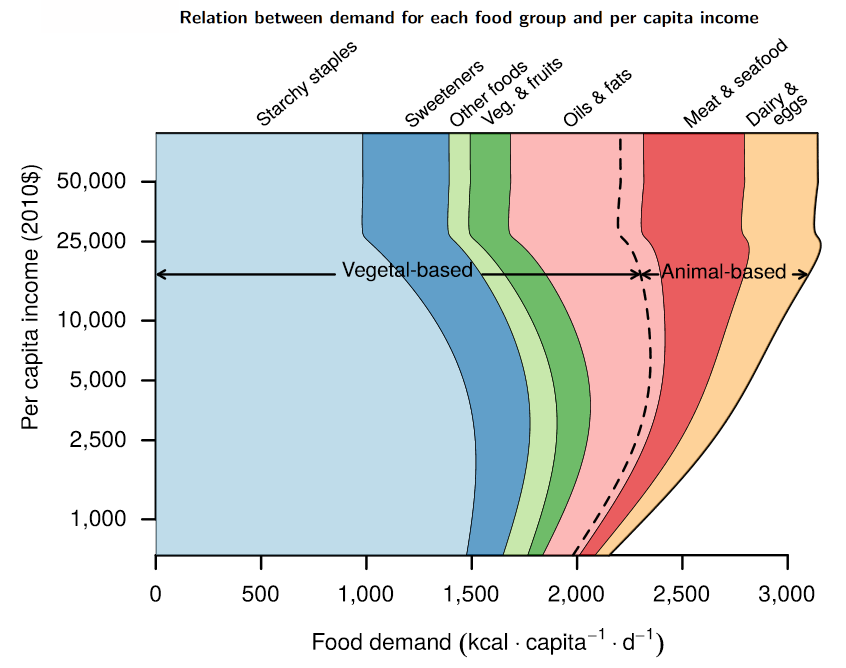

9.2 billion is the estimated number of individuals that the planet will have to feed by 2050. We estimate an economic model able to replicate the main features of the nutrition transition, which characterizes the evolution of diet with per capita income: rise in calorie consumption with increased income, diversification from starchy staples, and increased caloric demand for animal-based products, fats, and sweeteners. We use this model to project global food demand between 2010 and 2050. We predict an increase in caloric demand of 46% for 2050, mainly attributable to low-middle and low income countries. Using alternative projections of populations and revenues shows large uncertainties in the rise of demand for animal-based (alt. vegetal-based) calories, ranging from 78% to 109% (alt. 20% to 42%). Christophe Gouel & Houssein Guimbard >>> |

- Trade and Labor Market: What Do We Know?

Matthieu Crozet, Gianluca Orefice - Who is Afraid of the Brain Drain? A Development Economist’s View

Hillel Rapoport

- The international elasticity puzzle is worse than you think

Lionel Fontagné, Gianluca Orefice, Philippe Martin - Firms outcomes and local migrant workers supply

Cristina Mitaritonna, Gianluca Orefice, Giovanni Peri

- On the Current Account - Biofuels Link in Emerging and Developing Countries: Do Oil Price Fluctuations Matter?

Gabriel Gomes, Emmanuel Hache, Valérie Mignon, Anthony Paris - Banking Leverage Procyclicality: a Theoretical Model Introducing Currency Diversification

Justine Pedrono - Nutrition transition and the structure of global food demand

Christophe Gouel, Houssein Guimbard - The Role of Fees in Foreign Education: Evidence From Italy and the United Kingdom

Michel Beine, Marco Delogu, Lionel Ragot

- International Economics

N° 150 - Q2 2017

- Review of International Economics

Foreign Language Learning and Trade

Victor Ginsburgh, Jacques Melitz, Farid Toubal - Journal of Economic Surveys

The Circular Relationship between Inequality, Leverage, and Financial Crises

Rémi Bazillier, Jérôme Héricourt - Journal of African Economies

Mega-Deals: What Consequences for SSA?

Houssein Guimbard, Maëlan Le Goff - European Economic Review

Immigration and Firms' Productivity: evidence from France

Cristina Mitaritonna, Gianluca Orefice, Giovanni Peri

Can Innovation Help U.S. Manufacturing Firms Escape Import Competition from China?

May 5, 2017

Exchange Rate Disconnect in General Equilibrium

May 17, 2017

3rd MENA Trade Workshop

May 17 - 18, 2017

Gary Banks on "The Contribution of National Productivity Councils to Structural Reforms:

Insights from Australia"

June 7, 2017

Accounting Standards: where do we stand 10 years after the financial crisis?

October 17, 2017

17th Doctoral Meetings in International Trade and International Finance

June 26 - 27, 2017

Gross Capital Inflows to Banks, Corporates and Sovereigns

June 28, 2017

Michael Bordo on "The Second Era of Globalization is Not Yet Over: A Historical Perspective"

June 29, 2017

XV ELSNIT Annual Conference : Adjustment to Deeper Economic Integration

October 20 - 21, 2017

Export price, tariff and exchange rate: the international elasticity puzzle is worse than you think Unfair competition or exchange rate manipulations are recurrently used as arguments to justify retaliatory tariffs. The answers in the economic literature are incomplete or puzzling, and there is no consensus on the value the elasticity to trade costs In a recent paper, we shed new light on this debate by putting firm-level export prices explicitly at the centre of the analysis of the international elasticity puzzle (Fontagné et al. 2017). Our results, based on French firm-level data, confirm that, when estimated at the firm level, the tariff elasticity is higher (around 2) than the exchange rate elasticity (less than 1). This is the standard international elasticity puzzle. We go further by showing that the export price elasticity is even larger (around 5) than both the tariff and the exchange rate elasticities. Lionel Fontagné, Gianluca Orefice & Philippe Martin >>> |

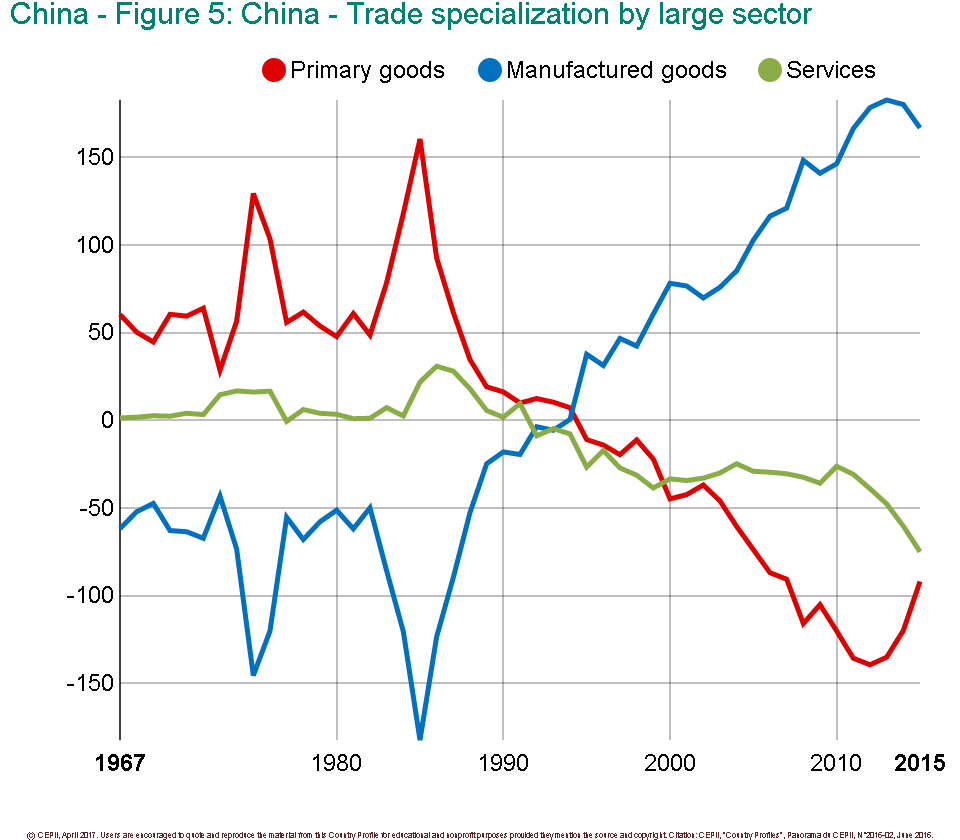

Country Profiles - Update May 2017 Unique tool to analyze international trade, CEPII Country Profiles put together and structure accurate and consistent information about income level, comparative advantages, products’ quality ranges and trade protection for 80 countries, based on CEPII databases. Interactive data, so they can fit different purposes, COUNTRY PROFILES have been designed so as to serve as an input for information, expertise and pedagogy, be it through its friendly-user illustrations or through downloadable data. Access on >>> |

- Contact us

- Our other sites

|

ISSN: 1255-7072

Editorial Director : Antoine BouëtManaging Editor : Dominique Pianelli