The implementation of a multilateral mechanism for sovereign debt restructuring that the UN is calling for, is illusory. However, progress could be achieved in different ways: improving the contractual terms, introducing new clauses on automatic debt reprofiling and using the leverage of international funding. [more] Christophe Destais See, in French, La Lettre du CEPII N° 357 >>> |

- Environmental policy performance bonds

Abdeldjellil Bouzidi, Michael Mainelli - Is the exchange rate – oil price nexus stable over time?

Valérie Mignon, Jean-Pierre Allegret, Cécile Couharde, Tovonony Razafindrabe - How Could We Finance Low-Carbon Investments in Europe?

Michel Aglietta, Etienne Espagne, Vincent Aussilloux, Baptiste Perrissin-Fabert - A €120bn investment programme for the European Union’s three-year Juncker Plan

Michel Lepetit - Financing the Green Climate Fund

Matthias Kroll - Climate Finance in the Context of Sustainable Development

Ottmar Edenhofer, Jan Christoph Steckel, Michael Jakob - After TPP: the EU shouldn’t rush into concluding TTIP

Sébastien Jean

- Quality Screening and Trade Intermediaries: Evidence from China

Sandra Poncet, Meina Xu - Should everybody be in services? The effect of servitization on manufacturing firm performance

Matthieu Crozet, Emmanuel Milet - Oil currencies in the face of oil shocks: What can be learned from time-varying specifications?

Jean-Pierre Allegret, Cécile Couharde, Valérie Mignon, Tovonony Razafindrabe - Immigration and the Gender Wage Gap

Anthony Edo, Farid Toubal - Disaster Risk and Preference Shifts in a New Keynesian Model

Marlène Isoré, Urszula Szczerbowicz - Changes in Migration Patterns and Remittances: Do Females and Skilled Migrants Remit More?

Maëlan Le Goff, Sara Salomone - Market Size, Trade and Quality: Evidence from French Exporters

Silja Baller

Fostering Investment in the European Union

October 29 - 30, 2015

Agriculture, International Trade and Development - 2nd Workshop MAD

November 19 - 20, 2015

Migration Rights Versus Labour Migration

November 20, 2015

Immigration in OECD Countries - 5th Annual International Conference

December 11, 2015

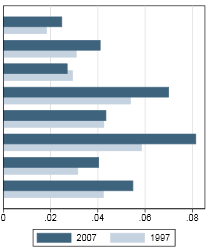

Part of the future of industry depends on services Using exhaustive data for French manufacturing firms between 1997 and 2007, a recent study by CEPII shows that firms that start selling services experience an increase in their profitability between 3.7% and 5.3%, increase their employment by 30%, increase their total sales by 3.7%, and increase their sales of goods by 3.6%. In 2007, about 70% of the French manufacturing firms produced some services for third parties. This share is growing over time. These servitized firms are larger (in terms of total production and employment), produce more goods and are more profitable. These positive effects of servitization strategies are mainly visible for small businesses. Matthieu Crozet, Emmanuel Milet >>> |

A new tool to analyze international trade Characterizing a country’s insertion in the world economy requires accurate and consistent information about its income level, comparative advantages, products’ quality ranges and trade protection. CEPII Country Profiles, being launched this month, offer a unique tool putting together and structuring all these aspects for 80 countries, based on the databases the CEPII has been developing for many years. Interactive data, so they can fit different purposes, this unique tool has been designed so as to serve as an input for information, expertise and pedagogy, be it through its friendly-user illustrations or through downloadable data. I wish to thank for their efforts all those who contributed to this project, under the guidance of Deniz Ünal, and I hope many of you will find it useful. Sébastien Jean, CEPII's Director |

CO2 bonds Issuing a environmental policy performance bond – call it CO2 government bond could be a simple and effective way for governments to enhance their funding, provided they engage in reducing their own CO2 emissions or increase renewable energy generation. The interest rates on these new bond types would be linked to CO2 reduction targets. For example, governments could set a rate of return on their bonds that pays investors more when the proportion of renewable energy over a year drops below a target percentage. Alternatively, the more a government reduces CO2 emissions the less interest the government pays. Abdeldjellil Bouzidi, Michael Mainelli More contributions >>> |

- Contact us

- Our other sites

|

ISSN: 1255-7072

Editorial Director : Antoine BouëtManaging Editor : Dominique Pianelli