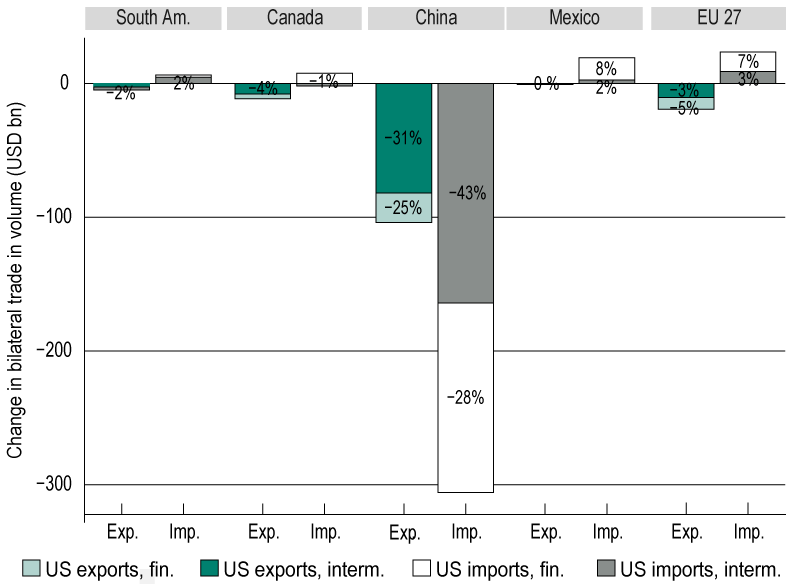

Protectionism in the Age of Global Value Chains : Assessing Long Term Impacts Since early 2018, the United States’ administration has taken several measures to limit US imports, in particular from China. The affected countries retaliated. In addition to the measures already implemented, the belligerents currently contemplate two alternative routes: either open new fronts (particularly in the automotive industry, targeted primarily against the European Union and in particular Germany but also to Japan), or have a rest to avoid further damages. According to our estimates, the measures already implemented would cause significant value-added losses to China (USD 91 billion in the long run), but also to the United States (62 billion), due to the intertwining of global value chains. As in any war, imposing losses on an enemy comes at a high cost. If the tariff war were to escalate, German industry would pay a heavy toll. The opposite path, a lull through an agreement on industrial goods between the United States and the European Union, would avoid undesirable outcomes, but would bring little gain per se to the parties. Cecilia Bellora & Lionel Fontagné >>> |

- The surprising sluggishness of French exports: reviewing competitiveness and its determinants

Charlotte Emlinger, Sébastien Jean & Vincent Vicard - The dollar and the Transition to Sustainable Development: From Key Currency to Multilateralism

Michel Aglietta, Virginie Coudert - Sectoral Reallocations, Real Estate Shocks and Productivity Divergence in Europe: A Tale of Three Countries

Thomas Grjebine, Jérôme Héricourt, Fabien Tripier - The design of a sovereign debt restructuring mechanism for the euro area: Choices and trade-offs

Christophe Destais, Frederik Eidam, Friedrich Heinemann

- The "new silk roads": an evaluation essay

(4/4): Obstacles on the road

Michel Fouquin, Jean-Raphaël Chaponnière

- The Exorbitant Privilege of High Tax Countries

Vincent Vicard - Heterogeneity within the Euro Area: New Insights into an Old Story

Virginie Coudert, Cécile Couharde, Carl Grekou, Valérie Mignon

- Shooting oneself in the foot? US trade policy coping with Global Value Chains

Cecilia Bellora, Lionel Fontagné

- Journal of Agricultural Economics

Agricultural Trade Liberalization in the 21st Century: Has it Done the Business?

Jean-Christophe Bureau, Houssein Guimbard, Sébastien Jean - Review of World Economics

Competing liberalizations: tariffs and trade in the twenty-first century

Jean-Christophe Bureau, Houssein Guimbard, Sébastien Jean

"The economic history of China's Empire and its influence on contemporary China" by Professor Richard Von Glahn, UCLA

June 4, 2019

Is Russia drifting away from an oil-rentier economy?

June 7, 2019

Presentation of the IMF note "Strenghtening the Euro Area: The Role of National Structural Reforms in Enhancing Resilience"

June 18, 2019

19th Doctoral Meetings in International Trade and International Finance

June 27 - 28, 2019

CEPII Workshop "Interplay between finance and macroeconomics in a global integration context"

July 1 - 2, 2019

The 2019 Euro-Latin Network on Integration and Trade (ELSNIT)

Conference hosted by the CEPII

October 23 - 24, 2019

Immigration in OECD Countries - 9th Annual International Conference

December 12 - 13, 2019

Sectoral Reallocations, Real Estate Shocks and Productivity Divergence in Europe: A Tale of Three Countries The creation of the European Monetary Union (EMU) in 1999 was expected to become a catalyst for real convergence in Europe. Far from being the case, real divergence increased from the early 1990s as evidenced by low productivity growth in the “periphery” of the Euro area relative to “core” countries. This report investigates the role of sectoral reallocation in this divergence, focusing on three archetypal countries: France, Germany, and Spain. Using the EU-KLEMS database of sectoral Total Factor Productivity (TFP), we first show that sector reallocations have been at the origin of productivity losses in the considered countries and contributed significantly to this divergence. Second, we investigate how the substantially diverging real estate prices between these countries could explain those sectoral reallocations. More specifically, when access to external finance is restricted due to financial frictions, real estate assets may be used as collateral by borrowers to relax these constraints and increase investments. Real estate shocks turn out to be a strong driver of productivity divergence, causing the lag of Spain behind Germany before the Great Recession and that of France afterwards. For comparison purpose, we also shed light on the role of sectoral reallocation in the UK productivity puzzle. Thomas Grjebine, Jérôme Héricourt & Fabien Tripier >>> |

The dollar and the Transition to Sustainable Development: From Key Currency to Multilateralism Drastic changes in US politics relative to international agreements and to bilateral relationships with China raise a political question about the key currency status of the dollar and a theoretical question in international monetary economics: Can a key currency system be maintained if the issuing country deliberately engages in conflicting protectionist policy? This policy brief investigates how the positions of major currencies have been changing in the international monetary system for several years. The key currency relies on the acceptance of the issuing country as a benevolent hegemon that delivers an economic policy conducive to international financial stability. Until recently, it appeared that, despite the relative shrinking of the US weight in the world economy, the dollar had maintained its dominance both in international payments and in official reserves. However, uncertainty in US policy is disrupting risk perception in heavily dollar-indebted emerging and developing countries. Besides, denying the services of international transactions for non-US-resident firms with countries under US embargo is a serious encroachment on the key currency system. Michel Aglietta & Virginie Coudert >>> |

- Contact us

- Our other sites

|

ISSN: 1255-7072

Editorial Director : Antoine BouëtManaging Editor : Dominique Pianelli